In the event you’re an early-stage Trader, you might think that monetary advisers are far too costly, but you can find distinct selections for various budgets:

Most retirement devices Never allow for penalty-free of charge withdrawals at fifty five, but usually there are some exceptions to this rule.

Homeownership guideManaging a mortgageRefinancing and equityHome improvementHome valueHome coverage

An in-particular person adviser supplies the very best level of provider and is particularly the only option for large and complex money portfolios that require estate arranging. There are also in-individual advisers who don’t in fact deal with your hard earned money, but just supply suggestions and steerage for an hourly payment.

Determined by where you’ve worked, you may be able to just take withdrawals from the pension on or before you decide to turn fifty five. Examine with all your employer to check out when you’re qualified. Teachers in California, such as, may possibly have the ability to retire at age fifty five if they have at least five years of service credit history

Homeowners insurance plan guideHome insurance plan ratesHome insurance policies quotesBest house coverage companiesHome insurance policies and coverageHome insurance policy calculatorHome coverage reviews

As soon as authorised by a lender, your resources are deposited directly into your account as soon as the next small business day.

But Remember the fact that the rule of 55 only relates to the retirement strategy connected with your last occupation prior to retirement and not to any new options affiliated with your new employer.

Cost savings is the key to fiscal freedom. From price savings, arrives investing. And click here from investing, will come asset development that will set you up for a snug retirement. Personally, I'm seriously purchasing property article-pandemic because it can be an inflation play. Inflation acts as being a tailwind for authentic asset costs. With regard to financial savings by age 55, your expense coverage ratio is The main ratio to ascertain.

“All profitable investing should abide by some kind of strategy,” states Moss. “It doesn’t work Except it’s directed towards a purpose. A fiscal advisor will function along with you to determine what the actual goal is, the amount cash you’ll need, and what investment decision methods will get you there.”

The most significant retirement errors consist of not conserving early, not getting healthcare fees into consideration, having Social Stability benefits early, and expending an excessive amount of cash in your early retirement yrs.

Underneath is usually a pre-tax and write-up-tax price savings manual by money degree. The higher your income degree, the upper your conserving price must be. By age 55, you have to be capable to have at least 20X your yearly expenditures saved up if you adhere to this guide.

Modern mortgage loan rates30 12 months home finance loan rates5-calendar year ARM rates3-year ARM ratesFHA home loan ratesVA mortgage ratesBest house loan lenders

But in specified conditions, the IRS is likely to make an exception and waive the penalty. The rule of 55 is one of those exceptions and economical procedures for early retirees.

Kel Mitchell Then & Now!

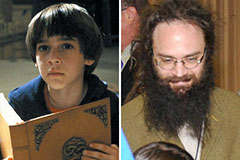

Kel Mitchell Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Alexa Vega Then & Now!

Alexa Vega Then & Now! Monica Lewinsky Then & Now!

Monica Lewinsky Then & Now! Soleil Moon Frye Then & Now!

Soleil Moon Frye Then & Now!